GST full form – Goods and Services Tax. kai salo se Isake Bare me charch Ho Rahi thi. aap Bhi Sochte honge ki Aakhir Ye GST kya Hai ? GST Indian Government Of India Ka Sabse Bada Decision. Jo Apane Desh Ko tarakki ki Or Le Jayega. Indian Country me Ab Tak Aapko Kai Tarah ke Tex Pay Karne Padte the. Ab Sabhi ke Liye Saman Tex Format Aa Gaya Hai. Itana Hi Nahi GST rate in india me bhi Bahot Benefits Aapko Milne wale hai. Narendra Modi ne Ise ” GST means Good and Simple Tax ” Kaha Hai. Yani garib Logo Ko Sabse Jyada Fayda Milne wala Hai. Government Ne Isake Liye GST Website bhi Lunch Kar di Gayi Hai. Jahan Se Aapko Account ka GST Number bhi Mil Jayega. jo tex pay Karne Me Jaruri ho Jayega. Is Article Me GST Information in Hindi, Benefits ( fayde aur Nuksan ), GST Pdf Jankari Hindi me Provide Ki gayi hai.

Dosto GST kya hai or GST Bill se kya fayda and nukhaan hoga ye me aaj aapko iss article me batane wala hu. Aapko tv par news channel ke dwara and internet par social media par GST ke bare me bhut si news dekhne ko mil rahi hogi. Lekin aap mese bhut hi kam log jante honge ki ye kya hai or GST se kya nussan or fayda ho sakta hai. Aaj me aapko issi ke bare full detail me batuunga.

GST kya hai? GST Information In Hindi

ye hai GST ka full form good & service tax hai. Jo ki ek indirect tax hai. Ye 1 july se state or government ke previous tax system ko replace kar dega. pahle aapko sabhi product par alag alag prakar ke tax dene hote hai jo ki 18 types ke hote hai lekin ab aapko only 1 GST tax dena hoga. Ye system export or direct tax jaise income tax or export par lagu nahi hota hai. Indian government dwara ab tak india ke tax system me jo bhi change huye hai ye unmese sabse biggest change hai. ye GST Information Padhe:

GST tax system slab – GST Rates

Gat ko 5 slab me devide kiya hai jin mese sabhi product nischit tax decide kiya hai.

Slab-1 (No tax) :

Jitne bhi basic good and services hai jaise ki milk, powder, sindur, stamp, egg, news paper etc inpar koi tex nahi lagega. Or jo hotal 1000 rupee se kam prices me customer ko services deti hai. Unpar bhi koi tax nahi lagega.

Slab-2 (5% ) :

Shoes and sleeper, tea, coal, small restaurant, Railway and Airport transport etc par 5% tax lagega.

Slab-3 (12%) :

Meets, cheese, fruits, toothpaste powder, ghee, sewing machine, cell phone, non a/c hotel, flight ticket etc par 12% tax lagega.

Slab -4 ( 28%) :

Pan masala, hair sampu, cleaner, moto bike, 5 star hotel, movie ticker etc ke liye 28% tax pay karna hoga.

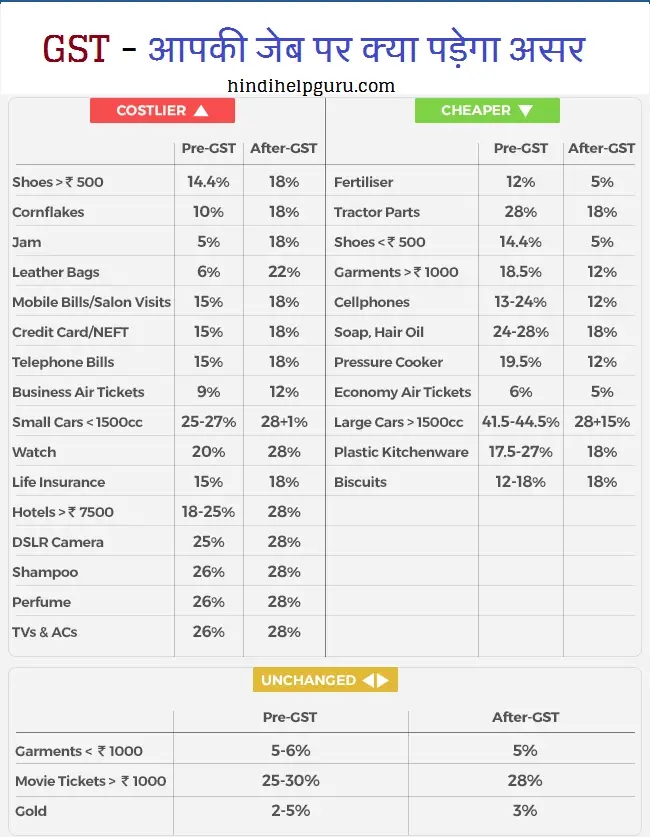

GST Se Kya Sasta Hoga Aur Kya Mahanga Hoga ?

Images For GST Information – Effect After GTS

- – Ye Bhi Padhe : Net Banking Safety kaise Rakhe ? 10 Security Tips Hindi

GST Tax se fayde or Nusksan kya hai ?

Read , GST Information For Benefits

Indian government ne tax system me new change kiya hai jisse ki kuch logo ko fayda hoga or kuch ko nuksan bhi hoga. GST me kuch product par tax ko kam kar diya gaya hai to kuch par tax bada diya gaya hai. Isska fayda ye hoga ki sabhi product par one tax pay karna and issme sabhi daily use me hone wale product par kam tax rakha gaya hai issliye daily use hone wale useful product par tax kam lagega. And usse product ka price bhi kam ho jayega jisse logo ko bhut fayda hoga. GST ka nuksan ye hai ki issme kuch product jaise paint, cement, telecom and insurance me pahle ke mukable jayeda tex pay karna hoga. online e – commerces site par effect padega.

Isake Alava online e – commerces site par pae GST ka asar aap dekh sakte hai bhut si E- commerces site ho pahle affiliate marking ki facility deti thi GST ke wajah se unhone band kardi hai.

GST Pdf File Hindi Font Full Information – Hindi Me Jankari:

GST Ko Samajne Me Bahot Der Lagati Hai. Ham Kuchh Samay ke Bad Hi Ise Puri Tarah Samaj payenge. Agar aap Is GST Information in hindi Font Padhana chahte Hai To wo bhi Yahan Available Hai :

- GST Information Hindi Font Me Padhe : Click – GST PDF Hindi

GST tax Benefits – fayde :

1. Tootpaste soaps ke liye pahle 25-26% tax pay karna hota tha ab aapko 18% pay karna hoga.

2. Four Wheeler or two Wheeler ke liye aapko 26- 49% tax pay karna hota tha jo ki ab aapko 21-46% pay karna hoga.

3. Sabhi Foods par aapko pahle 18% dena hota tha jo ab aapko 5% hi dena hoga.

4. mobile phone smartphone par pahle aapko 19% tex lagta tha jisse 1% kam kar diya gaya hai yani ki ab aapko 18% tax pay karna hoga. yani ab mobile ke price or bhi kam ho jayge and bhut se log jinke pass abhi bhi smartphone nahi hai vo asani se apna kudka smartphone buy kar payge.

GST tax Loss – nuksan:

1. Domain and hosting sites par aapko 11% tax pay karna hota tha jisse badakar 18% kar diya gaya issliye aapko agar online business ke liye domain name ya hosting buy karni hogi. To vo usske liye aapko pahle se jayeda pay karna hoga.

2. E- commerces sites jaise amazon, flipkart, snapdeal etc par bhi GST ka asar dekhne ko mil raha hai amazon ne GST ki wajah se apni affiliate marketing wali service ko band kar diya hai and ab product ka price bhi bada diya jayega.

3. airlines par pahle 90% tex pay karna hota tha jisse badhkar ab 15% kar diya gaya hai.

4. telecom and insurance site par pahle aapko 15% tax dena hota hai jo ki ab aapko GST ke baad 18% pay karna hoga. issse lic, kotak etc jo bhi insurances bank hai unme insurance policy ka plan bada diya jayega jisse logo ko apna ya bike moto ya shop kisi ka bhi insurance karane ke liye pahle se jayda money pay karni hogi. Ye thi Useful GST Information in Hindi.

Extra Inning :

GST Information me Aapne dekha ki iss tarah aap jan gaye honge ki GST kya hai or isse logo ko kya fayda and nuksan honga friends GST india ki puri jankari wali post aapko acchi lage to isse apne dosto ke sath social networking sites par share jarur kare or aapko isse related koi sawal hai to comment karke jarur batatye.

Aapko Ye Article ” GST Information In Hindi Jankari or GTS ke Fayade nuksan ” aapko Jarur Useful Laga hoga.

GST Information ko apane dosto ke sath Share Kare. Agar Aapka Koi Sawal hai To Hame Comment Me Bataye.

Nice Gst ke bare me aapne acchi information share ki hai.