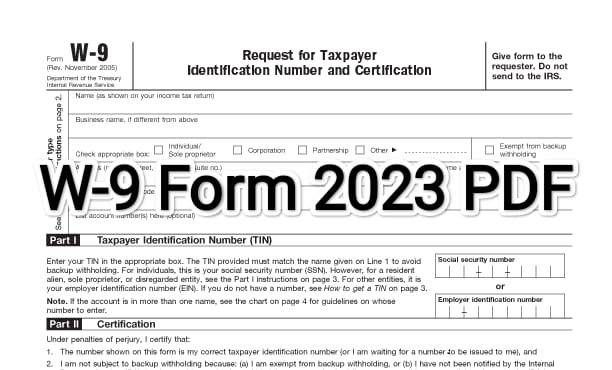

W-9 Form 2023 PDF Free Download

Whether you’re a freelancer, an independent contractor, or a business owner, the W-9 form is an essential document that plays a crucial role in your tax affairs. In this guide, we’ll delve into the intricacies of the W-9 form for the year 2023. From its purpose and significance to its completion and submission, we’ll cover it all.

What is the W-9 Form?

The W-9 form, officially titled “Request for Taxpayer Identification Number and Certification,” is a document used by businesses to gather information from individuals or entities providing services. It’s not a tax return itself, but rather a means for businesses to obtain the necessary details for tax reporting.

Why is the W-9 Form Important?

The information provided in the W-9 form is vital for accurate tax reporting. Businesses use this information to prepare Form 1099, which is sent to the IRS and the service provider, detailing the income earned. For the service provider, this information is used to report income on their tax return.

Key Components of the W-9 Form

Understanding the key sections of the W-9 form can help you complete it accurately:

Name and Business Entity

Provide your legal name as it appears on your tax return. If you operate under a business name, include that as well.

Tax Classification

This section determines whether you’re an individual, corporation, partnership, or other entity. Select the appropriate option that best reflects your status.

Exemptions

If you’re exempt from backup withholding or have been exempted by the IRS, you’ll need to specify your exemption code.

Address and TIN

Include your mailing address and taxpayer identification number (TIN). For individuals, the TIN is typically your Social Security Number (SSN).

Also Read This : Playground Aron Beauregard

How to Fill Out the W-9 Form

Filling out the W-9 form is straightforward:

Download the Form

Access the W-9 form from the official IRS website or through authorized tax software.

Complete Sections 1 and 2

Fill out your name, business name (if applicable), tax classification, and exemptions, if any.

Provide Address and TIN

Enter your mailing address and TIN, ensuring accuracy to prevent processing errors.

Certification

Sign and date the certification section to confirm the accuracy of the provided information.

Submitting the W-9 Form

After completing the W-9 form, you’ll typically submit it to the business that requested your services. They will use the information for tax reporting purposes.

FAQs About the W-9 Form

Que : Is the W-9 Form Mandatory?

Ans : Yes, if you’re providing services to a business, they may require you to complete a W-9 form.

Conclusion

In the realm of taxation and financial responsibility, the W-9 Form 2023 stands as a fundamental document. By understanding its purpose and correctly completing it, you ensure accurate tax reporting and contribute to the seamless functioning of the tax ecosystem.