PSLF Form PDF Free Download

In today’s fast-paced world, higher education has become more crucial than ever before. It opens doors to opportunities, but it often comes with a hefty price tag. Many students rely on student loans to finance their education, which can lead to substantial debt after graduation. Fortunately, there are programs like Public Service Loan Forgiveness (PSLF) that offer a glimmer of hope for borrowers burdened by student loans. In this article, we will delve into the PSLF program and guide you through the process of filling out the PSLF Form.

What is PSLF?

The Public Service Loan Forgiveness (PSLF) program is a federal initiative designed to provide relief to individuals with federal student loans. Under PSLF, eligible borrowers can have their remaining student loan balance forgiven after making 120 qualifying payments while working in a qualifying public service job.

Eligibility Criteria

To qualify for PSLF, you must meet several criteria. You must be employed full-time by a government or nonprofit organization, have eligible federal student loans, and make 120 on-time payments under a qualifying repayment plan.

Types of Qualifying Loans

Not all student loans are eligible for PSLF. Federal Direct Loans, including Direct Consolidation Loans, are eligible. However, Federal Family Education Loans (FFEL) and Perkins Loans are not.

Qualifying Repayment Plans

To make payments that count towards PSLF, you must be on a qualifying repayment plan. The Income-Driven Repayment (IDR) plans are popular choices, as they base your monthly payment on your income and family size.

Employment Requirements

You must work full-time for a qualifying employer while making the 120 payments. Qualifying employers include government organizations and 501(c)(3) nonprofit organizations.

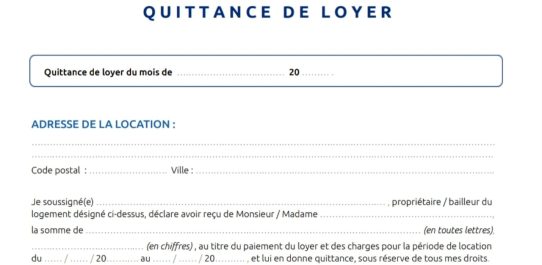

Completing the PSLF Form

Filling out the PSLF form is a critical step in the forgiveness process. The form, known as the Employment Certification Form (ECF), verifies your employment and loan repayment progress. It’s essential to complete this form annually and whenever you change employers.

Tips for a Successful Application

- Keep meticulous records of your employment and payments.

- Submit your ECF regularly to track your progress.

- Stay in contact with your loan servicer for updates.

Document Submission

When submitting your ECF, ensure that it is accurate and complete. Any discrepancies or missing information can delay your progress towards loan forgiveness.

Monitoring Progress

You can track your progress towards the 120-payment requirement through your loan servicer or the Federal Student Aid website. Staying informed will help you avoid any surprises down the road.

Common Pitfalls

Many applicants face challenges during the PSLF process, such as missing payments or incorrect paperwork. It’s crucial to be aware of these common pitfalls to ensure a smooth journey toward loan forgiveness.

Also Read This : Lazarillo De Tormes

The Approval Process

Once you’ve made 120 qualifying payments, you can apply for loan forgiveness. The Department of Education will review your application and notify you of the decision.

Rejection and Appeals

If your application is rejected, don’t lose hope. You can appeal the decision and work to resolve any issues that may have led to the denial.

Tax Implications

It’s important to understand the tax implications of PSLF. In most cases, forgiven student loan balances are considered taxable income, so you may face a tax bill when your loans are forgiven.

Alternatives to PSLF

If you don’t qualify for PSLF or want to explore other options, there are alternative loan repayment and forgiveness programs to consider.

Conclusion

The Public Service Loan Forgiveness program can be a lifeline for those struggling with student loan debt. By understanding the eligibility requirements, completing the PSLF form accurately, and staying committed to your public service career, you can pave the way to financial freedom.

FAQs

Q: Is PSLF available for private student loans?

A: No, PSLF is only applicable to federal student loans.

Q: Can I switch jobs while pursuing PSLF?

A: Yes, as long as your new job qualifies as public service and you continue to make qualifying payments.

Q: Are all federal student loans eligible for PSLF?

A: No, only Federal Direct Loans qualify. FFEL and Perkins Loans do not.

Q: How long does it take to get approval for PSLF?

A: The approval process can vary, but it typically takes a few months to review your application.

Q: What happens if I miss a payment while pursuing PSLF?

A: Missing a payment can affect your progress. It’s essential to stay on track and make all 120 payments.

Click Here To Download For Free PDF