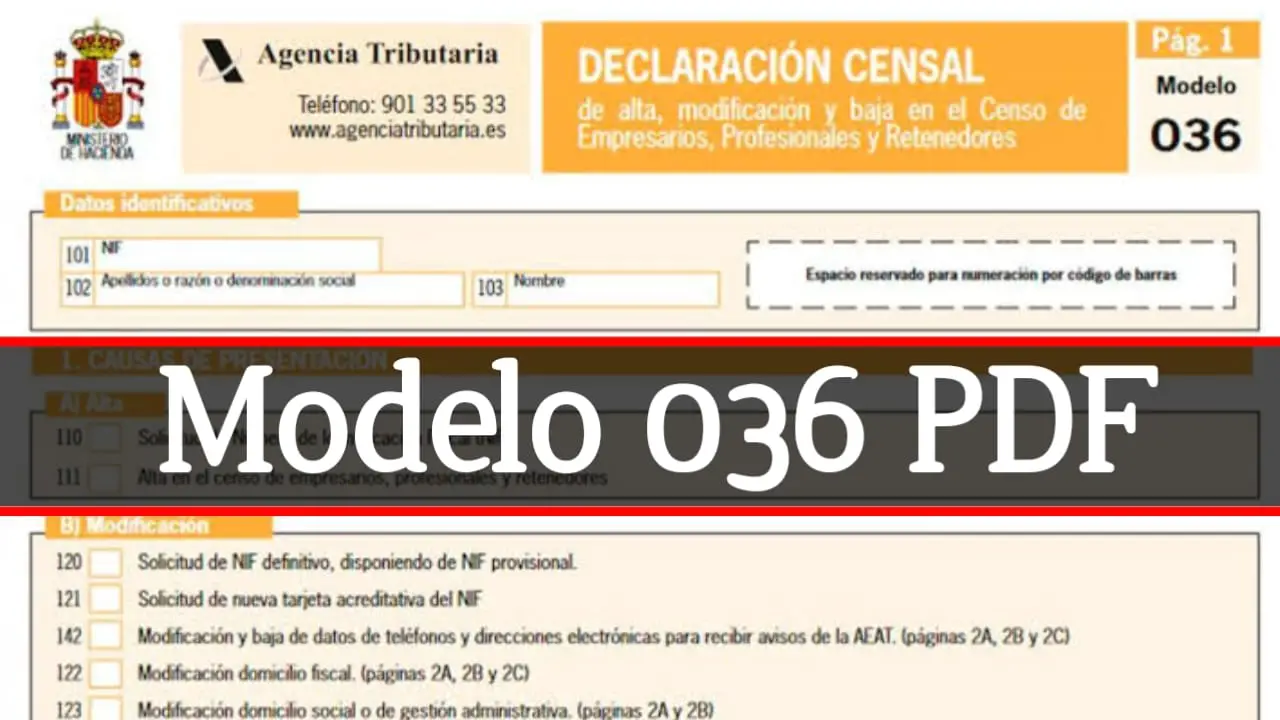

Modelo 036 PDF Free Download

In the world of taxation and paperwork, staying informed and up-to-date is paramount. One essential document that individuals and businesses need to be familiar with is the Modelo 036. In this comprehensive guide, we will delve into the intricacies of Modelo 036, exploring its purpose, how to fill it out, and why it’s crucial for taxpayers in Spain. Let’s navigate the maze of tax forms and demystify the Modelo 036.

What is Modelo 036?

The Modelo 036 is a tax form utilized in Spain, primarily for administrative purposes. It serves as a declaration of data concerning a business or individual’s economic activities, specifically in the context of Value Added Tax (VAT) and economic activities tax. Here’s a breakdown of its key sections:

Section 1: Identification Details

The first section of Modelo 036 requires you to provide your personal or business identification details. This includes your name, tax identification number (NIF), and contact information.

Section 2: Tax Regime

In this section, you will need to specify your tax regime. This is crucial as it determines your tax obligations and benefits. Common tax regimes include General, Simplified, and Objective.

Section 3: Economic Activities

Here, you’ll list the economic activities your business is engaged in. It’s important to be thorough and accurate, as this information helps tax authorities understand your tax liabilities.

Section 4: VAT Information

The Modelo 036 also covers your VAT-related details. You’ll need to specify your VAT regime, whether you’re subject to monthly or quarterly VAT payments, and other relevant VAT-related information.

Section 5: Data for Official Census

This section collects data for official census purposes, including information on the location of your business and additional economic activity details.

Why is Modelo 036 Important?

Now that we’ve covered the basic sections, let’s discuss why Modelo 036 is essential:

Tax Compliance

One of the primary purposes of Modelo is to ensure tax compliance. By accurately declaring your economic activities and tax regime, you reduce the risk of tax-related issues and penalties.

Registration

For businesses, Modelo 036 serves as a registration document. It’s often required when setting up a new business or making changes to your existing business structure.

Access to Benefits

The information provided in 036 determines your eligibility for certain tax benefits and deductions. Accurate reporting can lead to cost savings for your business.

Also Read This : GYG Nutrition

How to Fill Out Modelo 036

Filling out Modelo may seem daunting at first, but with the right guidance, it becomes manageable:

Gather Information

Before you start, ensure you have all the necessary information, including your NIF, business details, and tax regime information.

Online or Offline

You can complete Modelo both online and offline. The online version is available on the Tax Agency’s website, making it more convenient for many taxpayers.

Seek Professional Assistance

If you’re unsure about any aspect of 036, it’s advisable to seek professional help from an accountant or tax expert.

Conclusion

In conclusion, Modelo 036 is a vital tax form in Spain that individuals and businesses must understand and complete accurately. It plays a significant role in tax compliance, registration, and accessing tax benefits. Whether you’re a seasoned taxpayer or just starting, familiarizing yourself with a step towards financial responsibility.

Frequently Asked Questions (FAQs)

Que: Is Modelo 036 mandatory for all businesses?

Ans: No, Modelo 036 is typically required for businesses and individuals engaged in economic activities subject to VAT and income tax.

Que: Can I update my information on Modelo after submission?

Ans: Yes, you can make amendments to your Modelo if there are changes in your economic activities or tax regime.

Que: Is there a deadline for submitting 036?

Ans: Yes, 036 must be submitted before the start of economic activities or within one month of any changes.

Que: Are there any penalties for incorrect information on Modelo?

Ans: Yes, providing incorrect or incomplete information can result in fines and tax-related issues.

Click Here To Download For Free PDF